UBS Analysts said in a November note that Victoria’s Secret’s prices were up about 22% during the third quarter, and L Brands CEO Andrew Meslow said during an earnings call around that time that the company was working to increase the average price point of the promotions Victoria’s Secret ran. In recent quarters the company has decided to increase prices on some products, and run fewer promotions in the hopes that it can drive more revenue even as store sales fall. Still, given Victoria’s Secret’s nearly $7 billion in annual revenue, the company remains a large player in the retail industry. But, that deal was called off as the coronavirus outbreak worsened.

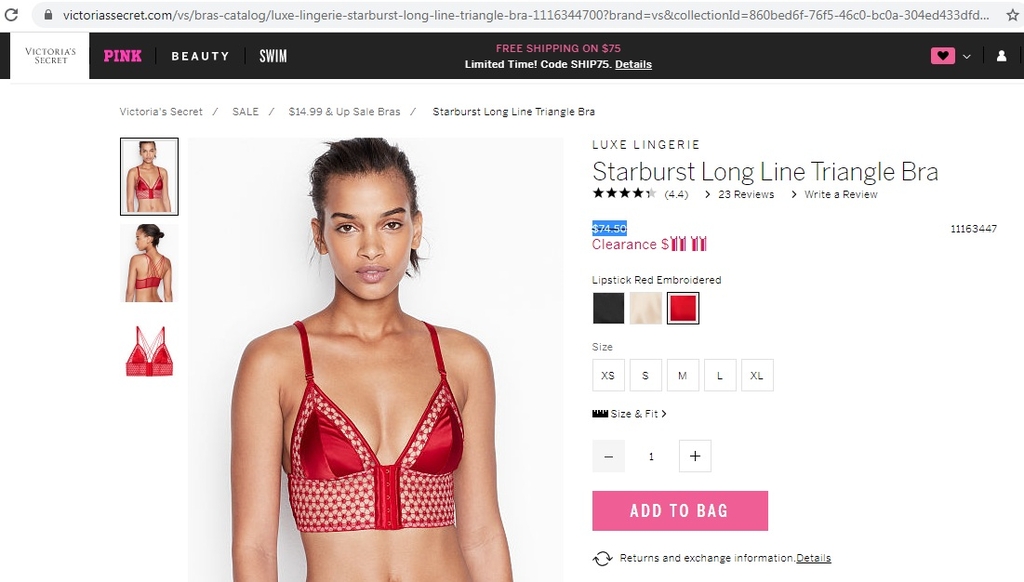

Sycamore Partners had previously announced a deal last February to acquire a majority stake in Victoria’s Secret, and eventually separate it, with the goal of turning the brand around. “It was inauthentic and the customer knew it,” she said. Santaniello said that Victoria’s Secret’s previous attempts at reinvention have been hampered by the fact that its messaging hasn’t always lined up - on social media, the company was more likely to include photos of a more diverse array of models, while in stores, it still primarily used heavily edited photos of supermodels. Meanwhile, Victoria’s Secret had previously been slow to carry more inventory in categories like bralettes, which had started to rise in popularity in recent years, said Gabriella Santaniello, founder of consulting firm A Line Partners. Some customers were starting to abandon the brand in favor of competitors like Aerie, whose photos featuring plus-sized models that weren’t retouched stood in stark contrast to the runway models that Victoria’s Secret heavily featured in its marketing.

Victoria Secret’s annual televised fashion show had started declining in popularity before the company ultimately canceled it in 2019. “Victoria’s Secret embraced a ‘less is more’ mentality very early on in the pandemic, allowing themselves to shrink revenues in an effort to grow profits and recent earnings results show that it is undeniably working,” Simeon Siegel, a managing director and senior analyst at BMO Capital Markets said in emailed comments.īefore the coronavirus pandemic, same-store sales had been declining for years. All of these moves are aimed at reestablishing Victoria’s Secret as a consistently profitable business. It’s also slowly getting back into new categories, most recently announcing this week that it will start reselling swim wear in select stores after previously exiting the category in 2016. For example, the brand has been cutting back on promotions, and also doing more limited-edition collections in order to reduce the inventory on hand. Retail analysts say that Victoria’s Secret’s recent moves have been less focused on trying to re-establish itself as the most-talked about brand in lingerie, and rather getting back to the fundamentals of retail. In 2019, Victoria’s Secret recorded revenue of $6.81 billion, a 7% decline over the previous year, and same-store sales this year have been declining by mid-single or double-digits each quarter, largely due to the coronavirus. Nearly a year after a proposed spin off of Victoria’s Secret from parent company L Brands was called off, the lingerie brand has been trying to quietly course correct some previous missteps.

0 kommentar(er)

0 kommentar(er)